Earlier this month, drug manufacturer Eli Lilly announced that it cutting the cost of two of its prescription brand insulins, Humalog and Humulin, by 70%, and capping out-of-pocket costs for privately insured patients at $35 a month. Competing drugmakers Novo Nordisk and Sanofi-Aventis followed in quick succession, announcing similar price cuts and caps.

Great news, right?

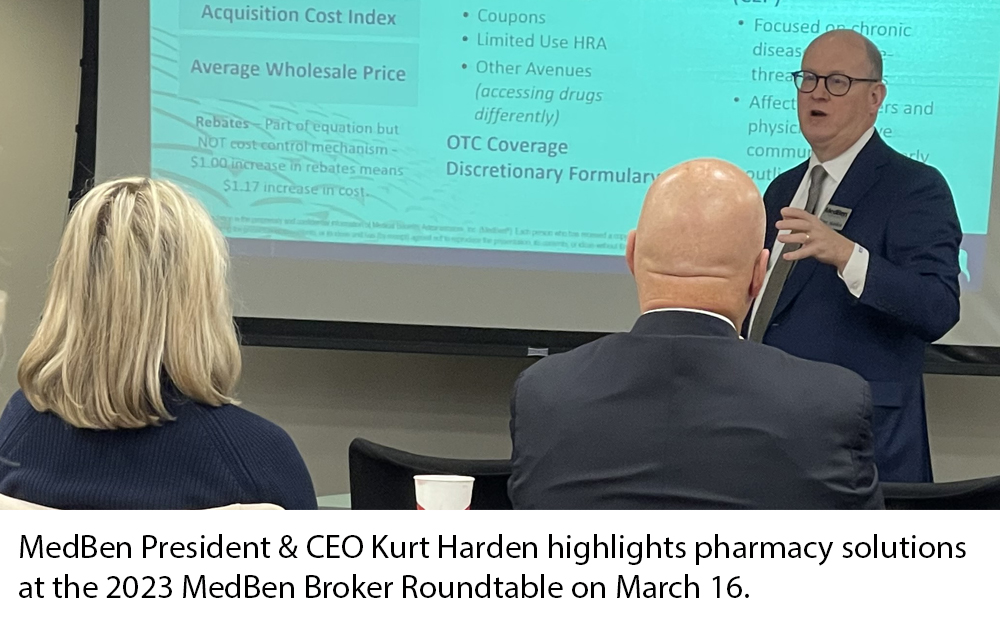

Well, while these announcements sound like a big deal, the reality is a bit less exciting. At the MedBen Broker Roundtable on March 16, MedBen President Kurt Harden observed that Lilly is simply repricing their insulin brand at the price of their insulin generic, or biosimilar, Lispro.

“Lilly is dropping the average wholesale price of Humalog from $42.43 to $12.73,” Harden said. “Do you know what the AWP of Lispro is? That’s right, it’s $12.73.”

Additionally, it’s yet to be seen how pharmacy benefit managers (PBMs) will respond if these drugmakers decide to rescind or substantially lower rebates on their insulins. The likelihood is that the drugmakers will offer smaller rebates and reduce its contract obligations with PBMs, and PBMs will respond with lower fixed copays to plan sponsors and members. Meanwhile, the drugmakers may continue to offer member copay assistance, with employers saving through the price drop.

All that said, MedBen Rx’s recommendation remains to take the lowest net cost available. Lispro as a generic has been around for a few years, and its value has exceeded that of brand rebates for at least a year… so instead of getting excited about overhyped price cuts, clients should continue to promote the use of the generic alternative.